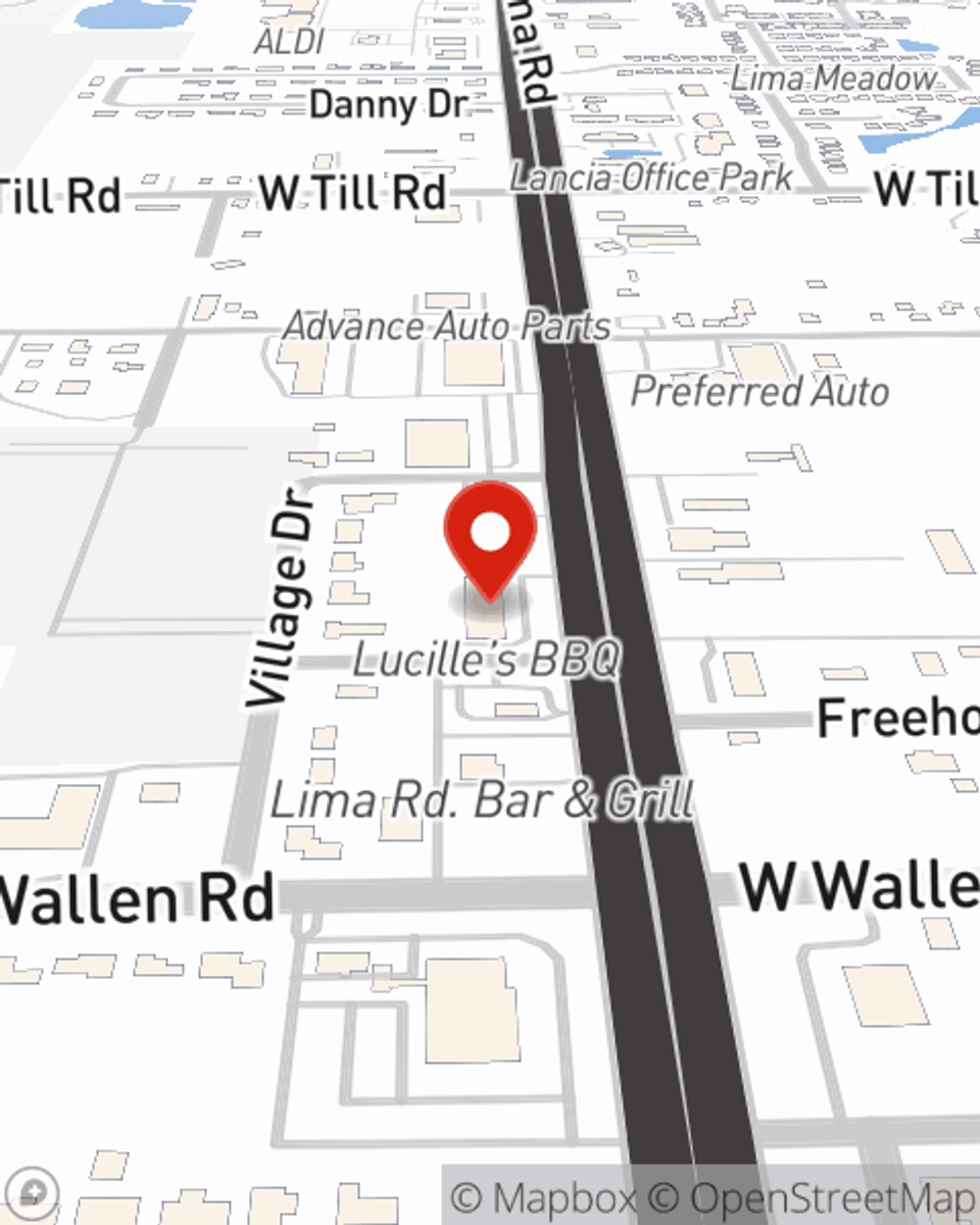

Business Insurance in and around Fort Wayne

Looking for coverage for your business? Search no further than State Farm agent Jordan Klopfenstein!

Helping insure businesses can be the neighborly thing to do

- Fort Wayne

- Ft Wayne

- Allen County

- Leo

- Grabill

- Huntertown

- Archbold

- Pettisville

- Wauseon

- Fulton County

- Auburn

- Dekalb County

- Bryan

- Dupont Road

- Lima Road

- Spencerville

- Henry County

- Williams County

- New Haven

- Woodburn

State Farm Understands Small Businesses.

Whether you own a a confectionary, a pharmacy, or a HVAC company, State Farm has small business insurance that can help. That way, amid all the various moving pieces and decisions, you can focus on making this adventure a success.

Looking for coverage for your business? Search no further than State Farm agent Jordan Klopfenstein!

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

Every small business is unique and faces a wide array of challenges. Whether you are growing a cosmetic store or a tailoring service, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your business type, you may need more than just business property insurance. State Farm Agent Jordan Klopfenstein can help with extra liability coverage as well as mobile property insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Jordan Klopfenstein is here to help you explore your options. Reach out today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Jordan Klopfenstein

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.